Explain the Different Sources of Finance for Small Industries

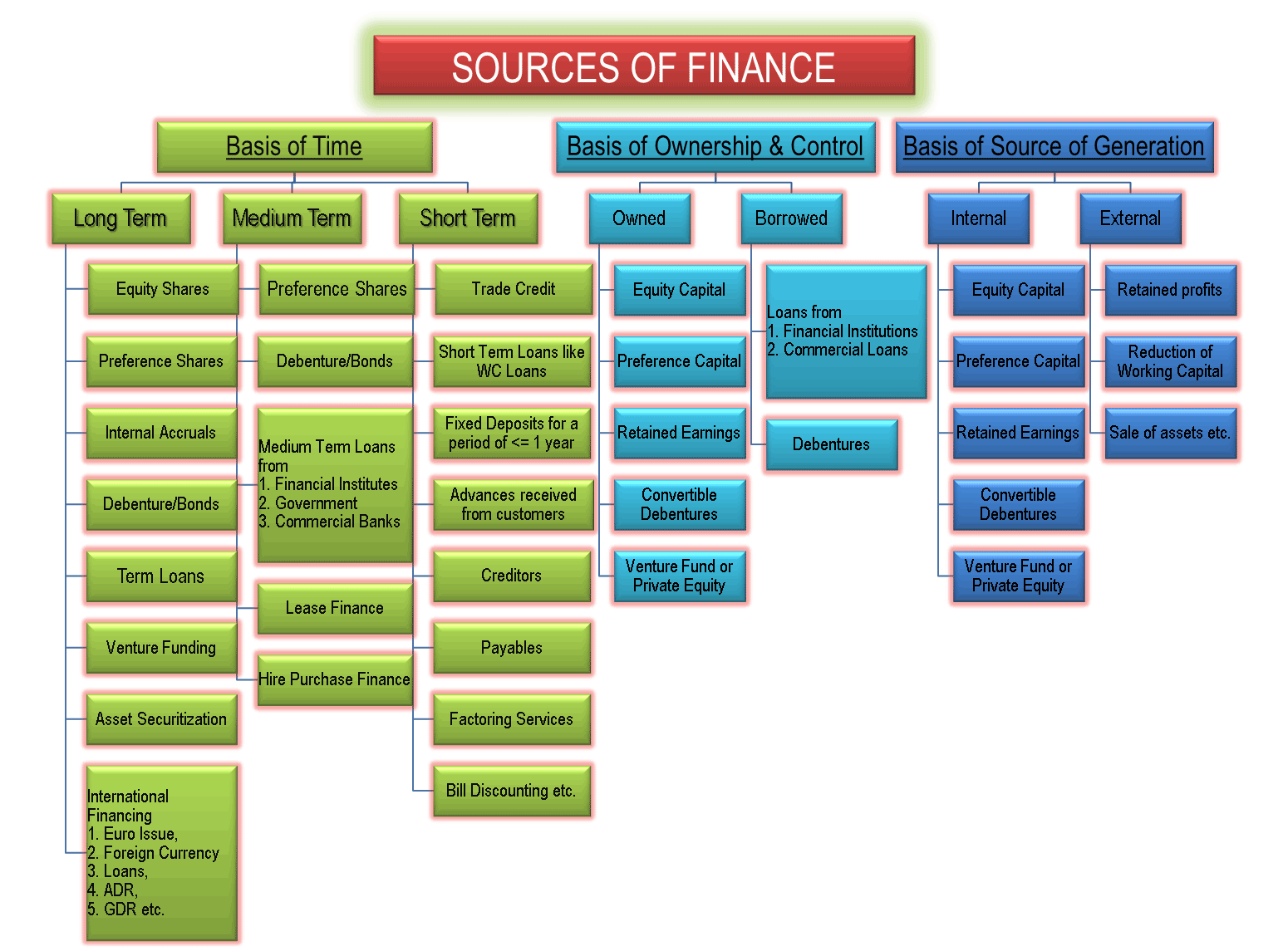

A Long term sources of business finance B Short term sources of business finance. Sources of Finance for Small Scale Industries.

Sources Of Finance Business Poster Business Finance Business And Economics Business Education Classroom

Parents siblings extended relatives friends who have excess cash to lend may be willing to finance.

. Internal which includes personal savings family and friends and external includes trade credit venture capitals business angle hiring and leasing bank loans Factoring and invoice discounting grant bank overdraft. Number one the easiest source of finance for a small business is ones own savings. Industrial Finance Corporation of India IFCI 5.

I9t also discusses the advantages and limitations of various sources and points out the factors that determine the choice of a suitable source of business finance. However if the business is confident of making the repayments quickly then an overdraft agreement is a valuable source of financing and one that many companies resort to. Traditional and Modern Source.

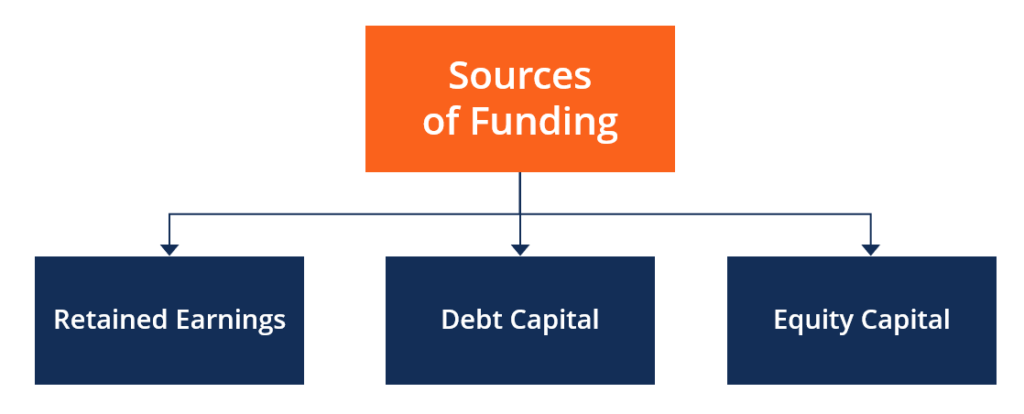

Some businesses can be started on a smaller budget while others may require considerable investment in. Companies use retained earnings from business operations to expand or distribute dividends to their shareholders. Equity Financing Equity financing means exchanging a portion of the.

Simple Secure Application. Ad Lending Help to Small Businesses Like Yours Since 2012. Employs between 20 and 99 people a small firm employs between 5 and 19 and a micro firm employs less than 5 employees which include self employed managers.

Another similar source of short-term business finance is a business credit card which is the most commonly used finance source for small businesses. One way to finance the equipment is to lease it through a finance company. Let us discuss the sources of financing business in greater detail.

The following points highlight the top ten sources of working capital finance. Commercial Paper CP 3. If your business grosses 10K or more per month Neal Business Funding can get you a Merchant Cash Advance Business Loan.

The following are the short-term sources of finance. Deferred Tax Payments 8. While some of the above-mentioned sources also provide funds for small-scale industries it may be useful to make a separate mention of their sources of funds as these industries differ from large-scale industries in such important matters as organisation scale of production collateralsecurity.

State Finance Corporations SFCs 2. Sources of finance for business are equity debt debentures retained earnings term loans working capital loans letter of credit euro issue venture funding etc. The main sources of funding are retained earnings debt capital and equity capital.

Since every business is different and has its own specific cash needs at different stages of development there is no universal method for estimating your startup costs. Foreign capital is also an important source of medium-term and long-term finance to industry. Some common source of financing business is Personal investment business angels assistant of government commercial bank loans financial bootstrapping buyouts.

1 Trade Credit 2 Accrued Expenses 3 Advance from Customers 4 Commercial Paper 5 Factoring 6 Leasing. In Japan small-scale industry is defined according to the type of industry paid-up capital and number of paid employees. SOURCES OF BUSINESS FINANCE INTRODUCTION This chapter provides an overview of the various sources from where funds can be procured for starting as also for running a business.

Companies can use the credit card to pay for any business-related expenses and wont incur any interest provided the outstanding balance is paid off by the end of the credit-free period usually 30-56 days later. Most equipment leases are structured so that the finance company buys the equipment and rents it. Sourcing money may be done for a variety of reasons.

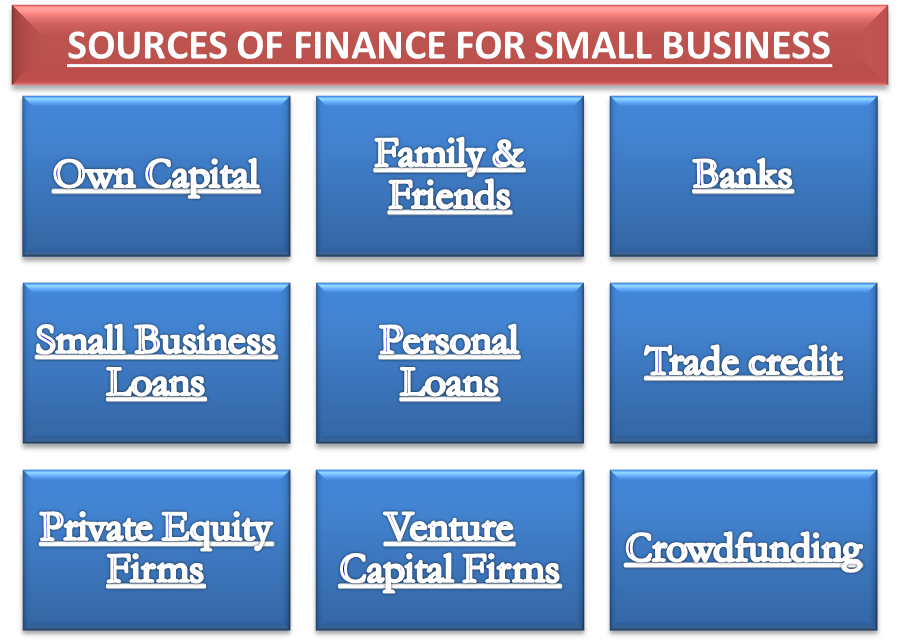

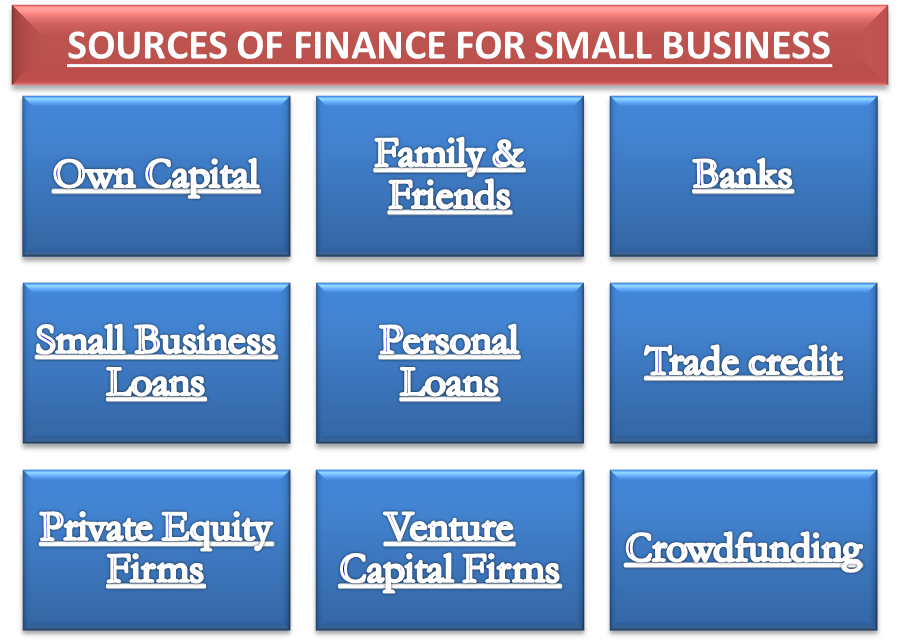

Government grants to finance certain aspects of a business may be an option. Sources of Finance for a Small Businesses Own Capital Savings. The bank sources of short term finance include.

These type of loans can fund within 2 days and can be the lifeline your business needs if you have have to have a cash flow injection in to your business quickly. Foreign capital is available to the industries both in the form of loans and equity participation. Of all the federally sponsored debt-financing programs this is the most popular and perhaps the best.

These sources of funds are used in different situations. Sources of Financing for small business or startup can be divided into two parts. Small businesses in certain industries need equipment to get started.

Equity Financing and Debt Financing. Short term sources of business finance have a repayment period of less than a year while long term sources have a repayment period of ten years and above. They are classified based on time period ownership and control and their source of generation.

Medium Term Source of Finance These are short term funds that last more than one year but less than five years. Businesses raise funds by borrowing debt privately from a bank or by going public issuing debt securities. Debt and equity are the two major sources of financing.

Many banks and non-banking financial institutions provide invoice discounting facilities. Under this system people keep their money as deposit with these companies or managing authorities for a period of six months a year two years. Intercorporate Loans and Deposits 2.

Funds Generated from Operations 4. Short Term Sources Of Finance for Small Businesses. The short-term sources of finance can be divided into two parts.

1 Year In Business Monthly Revenue 10K Required. The sources of foreign capital comprise international institutions like International Bank for Reconstruction and Development the International Finance Corporation foreign governments. Also incentives may be available to locate in certain communities or encourage activities in particular industries.

Consequently small and medium-scale enterprises are defined as. It loosens the flow of. Working Capital Loans from Commercial.

The source includes borrowings from a public deposit commercial banks commercial paper loans from a financial institute and lease financing etc. I Line of Credit. Some of the financial institutions supporting small scale industries in India are-1.

Start Your Funding Process Now. Deposits and Advances 10. It is also a debt-instrument mostly for short-term finance.

Therefore today we will discuss the various sources of finance divided into these two major sections. Short Term Source of Finance These are funds just required for a year. Industrial Credit and Investment Corporation of India ICICI Bank 6.

The sources of finance for start-ups and SMEs can be divided into two. Traditional areas of need may be for capital asset acquirement - new machinery or the construction of a new building or depot. SBA 7 a loans.

Another source is public deposits. Small Industries Development Bank of India SIDBI 4.

Internal Sources Of Finance Finance Financial Management Accounting And Finance

Sources Of Finance Owned Borrowed Long Short Term Internal External

Sources Of Finance For A Small Business Efinancemanagement Com

No comments for "Explain the Different Sources of Finance for Small Industries"

Post a Comment